KY Individual or Fiduciary: Kentucky follows the Federal mandate that a preparer must e-file KY individual returns unless they file 10 or fewer returns in a calendar year.KS Business: At present, corporate and partnership returns are not required to be filed electronically.Currently, the e-file requirement only applies to individual income tax returns. KS Individual: Tax return practitioners who prepare 50 or more Kansas individual income tax returns during any calendar year must file at least 90% of their Kansas individual returns electronically in successive years.IN Individual: Paid preparers who file 10 or more Indiana individual income tax returns must file those returns electronically.IL Business: Business and partnership returns must be electronically filed.(IL DOR Regs Title 86: Part 760 Section 760.100) IL Individual: Preparers who file more than 10 Illinois individual income tax returns must file those returns electronically.

Additionally, if a payment is required to be made electronically, then its associated return must also be filed electronically.

This means that a preparer who prepares more than 10 returns must e-file them. For any return required to be e-filed to the Federal government, its state counterpart must also be e-filed. Georgia follows the federal e-file guidelines.FL Business: Florida corporate income tax returns (C Corp and S Corp) must be e-filed if required to file the federal income tax returns electronically, or if $20,000 or more in Florida corporate income tax was paid during the prior state fiscal year (July 1 to June 30).CT Business: Composite Income Tax returns (S-Corp, Partnership) and Corporation Business Tax returns are required to be filed electronically.CT Individual: Preparers who prepare 50 or more Connecticut income tax returns are required to file all personal income tax returns electronically.CA Fiduciary: Fiduciary returns are not required to be e-filed.CA Business All business returns are required to be e-filed.

This requirement is waived if in the previous calendar year 25 or fewer returns were prepared.

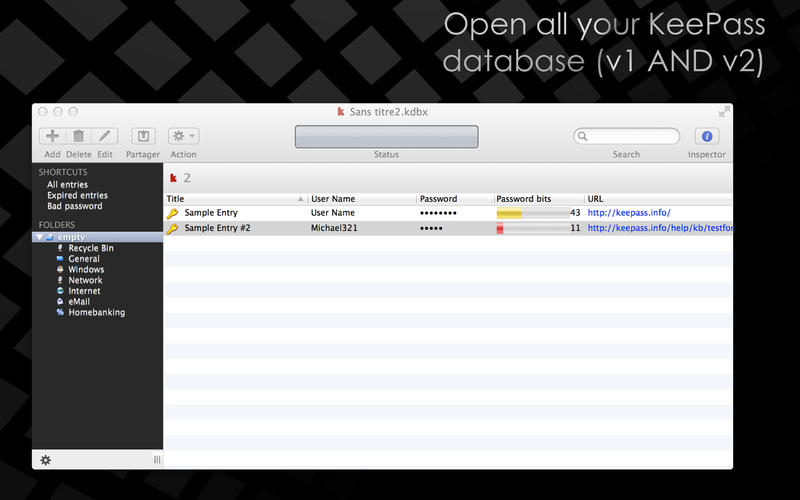

#Kypass support software

0 kommentar(er)

0 kommentar(er)